Read

Edit

History

Notify

Share

Yearn Finance

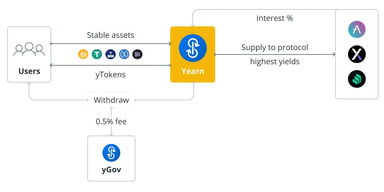

Yearn Finance is a decentralized finance (DeFi) platform that provides an array of DeFi products focused on creating a simple way to generate risk-adjusted returns. Its ecosystem converts resources from other DeFi platforms into synthetic assets to provide lending protocols, liquidity pools, and yield farming strategies. [1][2][3]

Yearn Finance utilizes many established DeFi protocols, including dYdX, Aave, Curve, and Compound, in its ecosystem. The platform was launched in February 2020 as iEarn, functioning primarily as a lending aggregator. It was rebranded as Yearn Finance in July 2020 with the introduction of a YFI token, governing the protocol. [4][10][11]

Overview

Yearn Finance was developed by Andre Cronje. It is a yield aggregator built on the Ethereum blockchain having a range of products designed to simplify and streamline many mechanisms within the DeFi space. The platform allows the creation of yield strategies through a process known as "Yearn Vaults." With Vaults, individuals, DAOs, and DeFi protocols can leverage vault integrations to build different kinds of projects. These can range from a play-to-earn (P2E) game to DAO tooling to an NFT project. Yearn Finance has its own native token, YFI, with a system of automated incentives around it. [4][5][6][7][8][9]

History

Early Beginnings (February 2020 - July 2020)

Yearn Finance was launched as iEarn in February 2020 by Andre Cronje as a yield arbitrage platform. iEarn supported stablecoins such as TUSD, USDC, USDT, DAI, sUSD, DAI-USDC, and wBTC on DeFi platforms like Fulcrum, Compound, Curve, Aave, Uniswap, lendf, dYdX, and ddex. The platform introduced APY (annual percentage yield), which compiles the interest rates offered by the various DeFi lending protocols. It later integrated Zap, which allows users to swap between liquidity pools on the Curve Finance platform. The introduction of Curve on iEarn positioned the platform to offer a liquidity pool, as curve pools are efficient at swapping stable values as well as bearing yield. With that, iEarn became a platform with three pools: compound.curve, USDT.curve, and y.curve pools. [12][13][14][15]

However, determining the pool with the best yield became difficult to measure. Although assumptions like higher liquidity and more pairs were used to determine the pool with the best yield, there were still problems with the yield aggregator. Five problems were incurred: “too large to gain yield," “too large to take advantage," “front-running volatile markets," “too big to move," and "risk/reward." These difficulties led to the development of a new yield farming product known as a yield-aware automated market maker (AMM). In July 2020, incentivized liquidity wars began among DeFi platforms, making yield farming complex. iEarn then developed new products by rebranding to Yearn Finance to meet yield farming complexities. [15][16][17]

Rebranding (July 2020-to-date)

When iEarn rebranded as Yearn Finance, its first product, v1, specifically focused on Aave yield assets, was released. However, a few problems were encountered because of its simplicity. Yield-stablecoins were launched to serve as an AMM transfer mechanism that benefits from Yearn’s yield improvements to the underlying AMM protocols while maintaining its own internal stability. Several products were released under Yearn Finance, including the YFI token, yearn.finance, trade.finance, yliquidate.finance, yleverage.finance, ypool.finance, and yswap.exchange. [16][18][19]

As yield farming became more complex, Yearn Finance launched v2. Also, v1's rigidity contributed to v2's launch. v2 comprised Yearn Vaults (yVaults), Controllers, and Strategies. yVaults are simple token containers functioning like Yearn Tokens (yTokens); Controllers control the mechanism, which is managed by governance; and Strategies maximize returns on assets. Strategies are created and controlled by Strategists, and anyone whose strategy is selected as the highest-performing strategy will receive funds every time the system receives rewards. On August 17, 2020, Andre Cronje announced the release of yinsure.finance, a prototype for tokenized insurance with three core components consisting of insurer vaults, insured vaults, and claim governance. [20][21] One of Yearn Finance's long-term objectives is to allow a wider range of strategies. With that, v3 was launched in September 2021, which iterates on V2 to increase robustness and develop Yearn’s path toward further decentralization. It was built with user experience, composability, and the multi-chain future in mind. [22][23]

In April 2023, Yearn Finance suffered a major hack from its legacy iEarn protocol and liquidity pool due to outdated contracts from vaults v1 and v2. The attacker minted over one quadrillion Yearn Tether (yUSDT) from $10,000 and then swapped the yUSDT for other stablecoins, including Binance USD (BUSD), Dai (DAI), Tether (USDT), Pax Dollar (USDP), and USD Coin (USDC). [24][25]

Products

Yearn has three primary products: yVaults, yCRV, and yBribe. [26]

Yearn Vaults (yVaults)

yVaults are the most complex Yearn Finance product. They provide automated yield generation for many DeFi protocols, which are driven by one or more Strategies. Strategies in the yVaults are developed by Strategists, and anyone can build a Strategy but there are rules guiding the process. A validated Strategist is an individual who has passed through some process that often revolves around security review, mainnet testing, and code review. [27][28] Below are yVault's uses: [8]

- It can be used as collateral for lending/borrowing

- To generate yield from user funds

There are three versions (v1, v2, and v3) of yVaults, but v1 has been disapproved. v1 vaults can only employ one Strategy per vault, while v2 vaults can employ multiple Strategies, up to 20 per vault. Some characteristics of v2 are: [29][30][31]

- There may be many active strategies at the same time in a yVault

- yVault tokens implement ERC-20

v3's purpose is to improve all core aspects of Yearn Vaults. There are different types of yVaults which include Ethereum, Fantom, Arbitrum, and Optimism Vaults. [31]

Ethereum Vaults

Most yVaults run on the Ethereum mainnet. The platform has developed over 250 strategies and 100 yVaults on Ethereum. [31]

Fantom Vaults

Yearn introduced yVaults on Fantom, which can employ multiple strategies per vault, just like Ethereum vaults. [31]

Arbitrum Vaults

Arbitrum yVaults can also employ multiple strategies per vault. Yearn integrated Arbitrum, an Ethereum-based Layer 2 (L2) solution, into its protocol to allow users to transact Ethereum-based tokens without moving them on the Ethereum blockchain itself. With this, Arbitrum became the first Ethereum L2 to be integrated with a DeFi protocol. Yearn chose Arbitrum because it is Ethereum’s largest L2, with almost $3 billion in TVL (total value locked). [31][32]

Optimism Vaults

yVaults was launched on Optimism in October 2022. Farming opportunities are available for some vaults, including WETH, DAI, WBTC, sUSD, and USDC. Just like Ethereum yVaults, Optimism yVaults can employ multiple strategies per vault. [31][33]

Yearn Vault (yVault) Token

yVault Token, also known as yvToken, is a yield-bearing ERC-20 compatible token that represents a user's share of the yVault they are participating in. yvTokens can be used as collateral, allowing users to lock tokens and borrow others. Some platforms using yvTokens as collateral are: [23][34]

- Inverse Finance

- Gearbox

- Alchemix

- QiDao

- Abracadabra

- Element

Yearn CRV (yCRV)

yCRV is a system that allows individuals to use special tokens/yVaults with varied functions. Three types of tokens exist in this product: yCRV, st-yCRV, and lp-yCRV tokens. [26]

yCRV Tokens

yCRV Tokens are used on the Yearn platform to interact with other Yearn's Curve-based offerings. They can be used for other purposes by permanently locking CRV to Yearn’s position in Curve’s locked voting token, known as "vote-escrowed CRV" (veCRV). [26]

Staked yCRV (st-yCRV) Tokens

st-yCRV tokens generate rewards from Curve admin fees and governance votes. [26]

Liquidity Pool yCRV (lp-yCRV) Tokens

lp-yCRV tokens generate rewards from providing liquidity in Curve’s CRV/yCRV pool. [26]

Yearn ETH (yETH)

yETH functions by tracking ether (ETH) liquid staking tokens (LSD). This is a way for Yearn Finance to hedge against the different protocols, which all have varying smart contract and liquidity risks. [35][36]

Yearn Bribe (yBribe)

yBribe enables veCRV holders, be they protocols, DAOs, or individual users who can vote on Curve governance proposals, to earn rewards. This is done when votes are sold to the highest bidders, who can vote on how CRV rewards are allocated. [26][37]

Yearn Token (YFI)

Yearn Finance's native cryptocurrency is YFI, an ERC-20 utility and governance token. YFI token holders are allowed to vote on community-submitted ideas, and any member of the governance forum can initiate Yearn Improvement Proposals (YIPs). Upon agreement by a majority of community members, the YIP will be submitted for official voting using the YFI governance staking mechanism. [38]

Governance

Yearn Finance is community-governed through a voting system. The more users who hold YFI governance tokens, the more influence they have on the decision-making process. Profits are obtained from each of Yearn's products and are periodically sent into governance contracts. To claim profits, YFI holders are required to stake their tokens into the contracts from the Yearn Treasury Vault, which temporarily holds profits before distributing them to stakeholders. [39][40]

Protocol Hack

On April 12, 2023, Blockchain security firm PeckShield recently detected a Yearn Finance hack that allowed the attacker to mint over 1 quadrillion Yearn Tether (yUSDT) from $10,000 in the latest decentralized finance (DeFi) exploit. The hacker then swapped the yUSDT to other stablecoins, allowing them to take hold of $11.6 million worth of stablecoins. PeckShield said that the hacker has already managed to transfer 1,000 Ether (ETH) worth almost $2 million to the sanctioned cryptocurrency mixer Tornado Cash. The DeFi protocols Aave and Yearn.finance were informed of the exploit. Yearn.finance stated that the issue was limited to an outdated contract before vaults v1 and v2 and that the current Yearn.finance contracts and protocols are not affected by the exploit. Aave confirmed that the hack did not impact Aave v1, v2 or v3. According to a quarterly report by blockchain security firm CertiK, more than $320 million were lost to hacks in the first quarter of 2023, which is much lower compared with previous years. [41][42]

Yearn Finance

Commit Info

Edited By

Edited On

August 13, 2023

Feedback

Average Rating

How was your experience?

Give this wiki a quick rating to let us know!

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

[17]

[18]

[19]

[20]

[21]

[22]

[23]

[24]

[25]

[26]

[27]

[28]

[29]

[30]

[31]

[32]

[33]

[34]

[35]

[36]

[37]

[38]

[39]

[40]

[41]

[42]