Read

Edit

History

Notify

Share

Switcheo

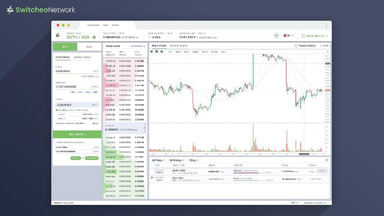

Switcheo (SWTH) is a decentralized exchange (DEX) integrated with three blockchains including NEO, Ethereum, and EOS blockchain to support ERC-20, NEP-5, and EOS tokens. The cryptocurrency trading platform also offers Over-the-Counter services and has Atomic Swap markets which allow traders to do cross-chain trades without requiring a trusted third party. [1]

Overview

Switcheo is a decentralized exchange (DEX) based in Singapore, it was launched on 12 February 2018. It is certified by Singapore FinTech Association as a blockchain and distributed ledger provider.

The Singaporean team behind Switcheo first called attention to their project by winning a dApp competition hosted by City of Zion, the global open-source community for NEO, in December 2017. This was followed by a whitepaper in February 2018 and an ICO that ended on March 17, 2018. [2]

The ICO hit its cap of $8.7 million within 24 hours. The first version of Switcheo went live days later. The Switcheo platform is currently in its second version (released on July 25, 2018). Switcheo has multiple partnerships with NEO, Uniswap, and most recently with Zilliqa.[3]

In January 2020, Switcheo announced an equity investment by Neo Eco Fund, underscoring Neo's strong community commitment through its EcoBoost initiative. Since its launch in May 2019, the Neo EcoBoost program played a key role in accelerating the growth and development of the Neo ecosystem by providing entire life-cycle support for projects and developers, thus showcasing Neo's community-centric ethos.[4] In addition to investing in Switcheo, Neo is also committed to supporting the Switcheo Token (SWTH) by financing the redemption of SWTH tokens for GAS tokens to further boost confidence in the SWTH token by funding the SWTH/GAS market on Switcheo Exchange. [5]

Switcheo Ecosystem

Demex

Demex is a fully decentralized platform that supports any type of financial market possible. Demex is powered by Switcheo TradeHub, an open-source, DPOS (Delegated-Proof-Of-Stake) order matching engine built on top of the Tendermint Core byzantine fault-tolerant consensus mechanism. It is claimed that Switcheo TradeHub can handle more than 1,000 transactions per second (TPS) and a peak load of 10,000 TPS. Using Demex, Validators receive a share of all transaction fees as staking rewards. Collateralized Debt Position Vault mints algorithmically maintained iUSD stablecoins to bootstrap liquidity.

On September 9, 2020, Demex went live on the public testnet. [6]

Carbon

Carbon is a decentralized layer 2 cross-chain trading protocol engineered by Switcheo Labs, designed specifically to support trading of sophisticated & advanced financial instruments such as options, bonds and futures, at scale.

Carbon is a custom-built sidechain that utilizes underlying technology from Cosmos Tendermint Core comprising:

- Tendermint Core

- Cosmos SDK

- IBC Protocol

Switcheo Foundation

Switcheo Foundation is a not-for-profit endeavor. Its mission is to create an open ecosystem for fair, self-regulating financial markets that are free from manipulation and intervention from centralized entities. This foundation does not have a direct relation to Switcheo Exchange or the Switcheo Token other than sharing their branding and vision.[7]

In July 2020, the Switcheo Foundation announced its intent to transition into a Decentralized Autonomous Organization (DAO) structure. The DAO structure would mean that responsibility for project governance would shift to token holders, who would review and vote on TradeHub Improvement Proposals for Switcheo’s decentralized marketplaces. Under this system, the SWTH token will also serve as the native currency for future listing fees, which will be distributed to token stakers in a similar fashion to other fees collected by the exchange.

Switcheo Token

The Switcheo token (SWTH) was launched alongside Switcheo Exchange, as a mechanism for paying commissions (trading fees) on trades matched by Switcheo. As stated in the Switcheo white paper, paying trading fees using this token allows traders to get a discount.

Switcheo upgraded their SWTH nep-5 token smart contracts in October of 2020. The change was made in order to move from a deflationary model to an inflationary one, eventually growing the total supply from 1,000,000,000 to 2,160,000,000 billion tokens over 5 years. The supply will be increased by an emission rate of 1.92% of the new supply, which will then decay by 1.65% each week. for 5 years. The upgrade allows for the code to be cleaned and made compatible with new protocols like Flamingo Finance.

Switcheo released a statement about the upgrade:

"We feel the introduction of this new monetary policy is a significant improvement as it will better incentivize active usage of SWTH and will quickly reduce the floating supply of SWTH during the ramp-up period of Switcheo TradeHub."

Liquidity Pools

One of the utilities for the SWTH token is the ability to contribute to liquidity pools on Switcheo TradeHub to facilitate automated token swaps. Switcheo TradeHub is an open-source, Dpos (Delegated-Proof-Of-Stake) order matching engine, powering both the Switcheo Exchange and Demex. An incentive model is planned for users who contribute tokens to these pools.

In a similar mechanism to the MakerDAO protocol’s dollar-pegged DAI asset, which is secured by a value of Ethereum locked in a smart contract, SWTH holders are able to lock their SWTH tokens and mint USD-pegged tokens to participate in Switcheo’s native liquidity pools.

Margin Trading Insurance

The SWTH token is also planned to have a role in the insurance fund system of Demex. Switcheo’s insurance will be largely funded by forced liquidations of losing positions that occur above their bankruptcy price, and will pay premiums to fund underwriters and token stakers when it grows larger than needed to insure the exchange. SWTH holders will have the opportunity to directly underwrite the insurance fund, and in return, they will be first in line to benefit from any future payouts of insurance fund profits.

Team

- Ivan Poon - Co-Founder, CEO

- Henry Chua - Co-Founder, COO

- Jack Yeu - Co-Founder, CCO

- Yik Jiun Lee - CTO

- Terence Toh - COS

- John Wong - VP Engineering - Blockchain

- Sng Ping Chiang - Developer

- Lim Jia Rong - Developer

- Chan Jun Wei - Developer

- Faye Xie - Product Lead

- Clemence Yeung - UI/UX Designer

- Dany Le - UI/UX Designer

- Prema Tsamy - Marketing Executive

- Yanyan Luo - Marketing Intern

Advisors

- Yingyu Wang - Advisor Director, Advocate & Solicitor

- Roger Lim - Advisor

Switcheo

Commit Info

Edited By

Edited On

September 28, 2022

Feedback

Average Rating

How was your experience?

Give this wiki a quick rating to let us know!

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]