Read

Edit

History

Notify

Share

Rari Governance Token

Rari Governance Token (RGT) (launched July 2020) is a cryptocurrency created on the Ethereum blockchain that serves as a native Governance Token to the DeFi protocol, Rari Capital. Rari Capital is a powerful yield farming tool that helps users to earn the highest yield on their stable assets within the DeFi ecosystem. RGT token can be used to propose and vote proposals made by the Rari Team or fellow token-holding community members[1][2][3][4].

Company

Rari Capital is founded by young entrepreneurs David Lucid (19), Jack Lipstone (19), Jai Bhavnani (18) in May 2020. It is the first non-custodial organization that aims to produce lossless returns to investors through unique DeFi strategies. The company is working on building a series of products with the goal of increasing market efficiencies within the crypto-sphere. The Yield harvesting tool is the starting point of their products.

Founders & Team

Jai Bhavnani (CEO) and Jack Lipstone (COO) have been in the crypto field for a while and previously worked at California, US-based company MyCrypto. Jai and Jack are high school classmates from Mar Vista, Los Angeles, CA. They developed and later sold a DeFi wallet, Ambo, to MyCrypto. David Lucid is also a veteran in the crypto space and had created a Decentralized Exchange (DEX). He previously worked as a CTO of CRAFT Scooter before returning to the crypto ecosystem. The Rari team consists of young members and that includes Ben Mayer (14), Justin Yu (17), and Richter Brzeski (19). The team is working with the Chicago DeFi Alliance to create a vibrant ecosystem that will appeal to and attract traditional financial players[5][6][7].

Overview

As mentioned above, Rari protocol is the most powerful yield harvesting tool that allows users to safely earn the highest yield on stable digital assets. It is commonly described as "The Smartest Stable Robo-Advisor”. Rari is a cross between an aggregator deploying lending strategies across multiple liquidity pools and a more traditional active manager with proprietary allocation strategies. The protocol automatically re-balances the funds to earn yield by using different strategies like

- Lending between lending major DeFi protocols like Compound, dYdX, and Aave.

- Swapping between stablecoins for arbitrage and yield optimization .

- Farming yields from protocol-based rewards like Compound, yEarn, and others.

Rari Capital v1 went live in July 2020 and the initial deposit limited to $350 per user. The Rari capital reached $95M USD in TVL within few days of launching[8]. Version 2 with a new liquidity pool, new strategies, multiple pool dashboard, decentralized governance, and governance token (RGT) were introduced in October 2020[9][10].

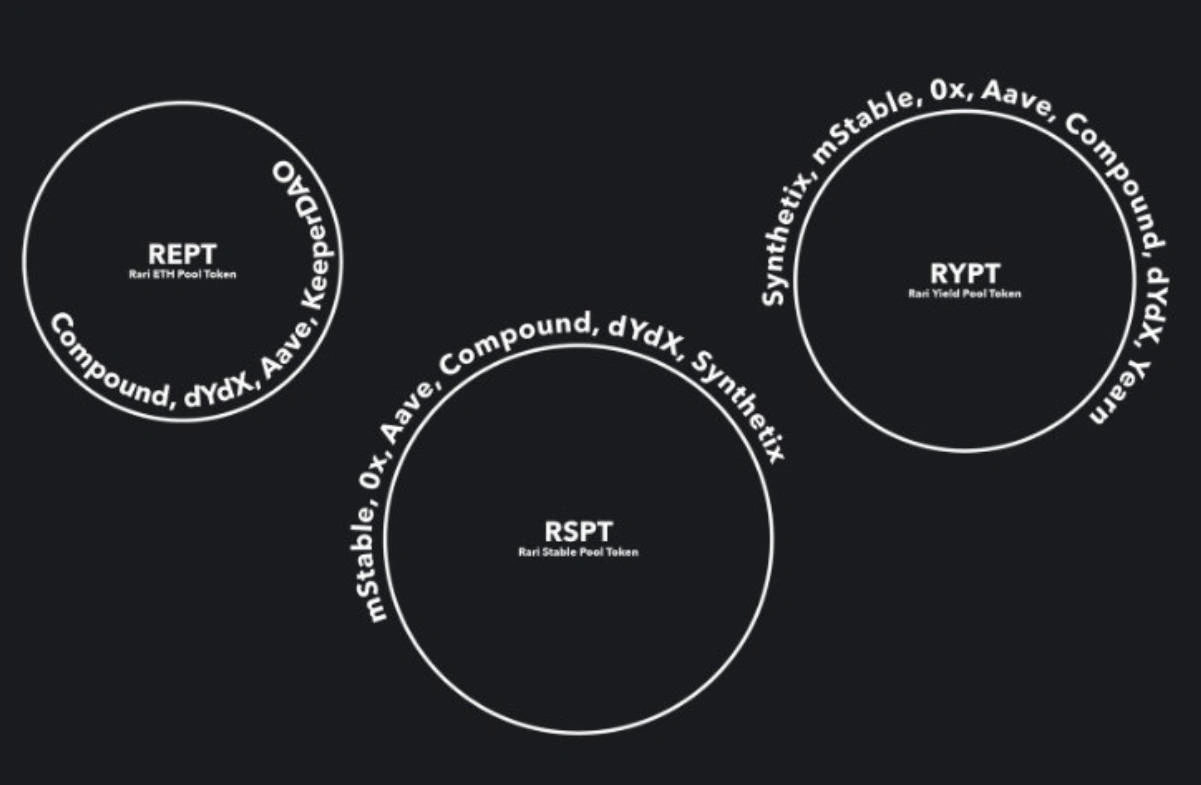

Rari Pools

Rari capitals have three different pools and these are categorized using depending on various factors that include strategies, risks, etc. So the Annual Percentage Yield returns differ significantly for each pool[11]. These pools are as follows

Rari Stable Pool (RSPT)

The first pool is the stable pool (RSPT) which interacts safely with exclusively audited smart contracts. It allows users to deposit ETH or any ERC20 Token to mint the native token called RSPT. All ERC20 deposited will be swapped to USD Coin (USDC). Once the user deposits in a stable pool, the Rari protocol starts working autonomously to deliver the highest yield on his USDC. The Rari stable pools currently optimize strategies to earn the highest interest possible by lending USDC on Compound, Aave, dYdX, or/ and providing liquidity to mStable.

Rari Yield Pool (RYPT)

The second pool is the yield pool (RYPT) that will maximize yield at all costs, whether it is leverage or un-audited smart contracts. This pool will always have the highest returns. It gives users the opportunity to earn a high interest by depositing ETH or any ERC20 tokens. When users deposit any amount it mints the native token, RYPT. The Rari protocol then algorithmically searches for the highest yield possible through the "risky" strategies. It automatically re-balances between stablecoins to get a higher yield. It uses different strategies like

- Lending Dai, USDC, and USDT on Compound

- Lending Dai, USDC, TUSD, USDT, sUSD, and BUSD on Aave

- Lending Dai, USDC on dYdX

- Providing liquidity to mStable, and also to Curve Finance, Cream Finance, dForce via yield aggregator, yEarn, and switching between vaults (e.g yCRV)[12]

Rari ETH Pool (REPT)

The 3rd pool is the ETH pool (REPT) it works to deliver safe and stable returns with ETH as the base asset. It allows the Rari users to deposit ETH or ERC20 tokens to immediately start earning interest through the minted token, REPT. While maintaining exposure to the price of ETH, users earn interest via strategies like Lending ETH on Compound, Aave, dydx, etc, or /and earning yield from liquidations (facilitated by KeeperDAO).

The differences between these three pools are summarized in the table below.

| Sr No | Stable Pool | Yield Pool | ETH Pool |

|---|---|---|---|

| 1 | Stable Returns | Maximum Yield | Stable and Safe Returns |

| 2 | Lending or provide liquidity in stablecoin | Leverages high yield protocols with re-balancing of stablecoins | Earns interest in ETH by lending it on different protocols. |

| 3 | Interacts only with Audited smart contracts (protocols) | Leverages un-audited smart contracts to get the maximum yield possible | Interacts with well-known lending protocols, exchanges(DEX), etc. |

| 4 | Earns interest in stablecoin | Earns interest in stablecoin | Earn interest in ETH |

Rari Governance

As mentioned in the introduction RGT is the governance token for Rari protocol. The Rari Governance empowers anybody to be able to dictate the future of the Rari Protocol. The RGT is able to control every aspect of the protocol, treasury, and charity. To participate in Rari governance, the user has to own RGT. Then, using that RGT, he will be able to vote on community drafted proposals or draft his own proposals to govern the Rari Protocol and ecosystem[13].

The RGT token holders can play many different roles in not only decision-making process, but also edit core parameters regarding pools. Some of these areas are[14].

- Maintaining Governance: The token holders can vote for decisions to integrate new protocols, edit pool parameters, edit risk parameters, etc

- Pass-through Governance: If a pool accumulates other tokens like COMP, BAL, the token can serve as a pass-through for their governance.

- Fee Discounts: The token can be used for fee discounts from the Rari Protocol.

Rari Treasury

The Rari Treasury is built on Rari Protocol's long-term growth. The Rari Treasury is managed by the DAO members that can include anyone who owns RGT token. 25% of all fees generated by the Rari Protocol allotted to Treasury and its use or purpose will be decided by governance proposals. These proposals can be about contributor compensation , expansion , audits , partnerships , Hosting services and all other Rari related services.

Rari Foundation

The Rari Capital team is dedicated to security on both the Rari Capital portal and the general atmosphere of DeFi. The Rari Capital Foundation is taking the liberty to help support in auditing, reviews, etc to early-stage underlying protocols that will hopefully one day be integrated into the Rari Protocol and grow DeFi as a whole. 2.5% of all fees are allocated to this audit pool. Currently, the Rari core team is in charge of the foundation but they have planned to make a transition over to the DAO. Rari Capital will help small teams pay for audits if they believe that the protocol is remarkable and the team has a strong vision.

Rari Forum

The Rari Capital Governance Forum was released on November 18, 2020, and anyone can participate or start a discussion or make a proposal regarding protocol and contribute to the project.

RGT Tokenomics

Rari Governance token (RGT) is an ERC20 Token created by deploying smart contracts on the Ethereum blockchain. The total supply is initially set to 9,670,894 RGT[15]. It registered all-time of $5.72 on Oct 23, 2020, and all-time low of $0.213385 on Nov 05, 2020. It is currently listed on Uniswap and Bilaxy cryptocurrency exchanges[16]

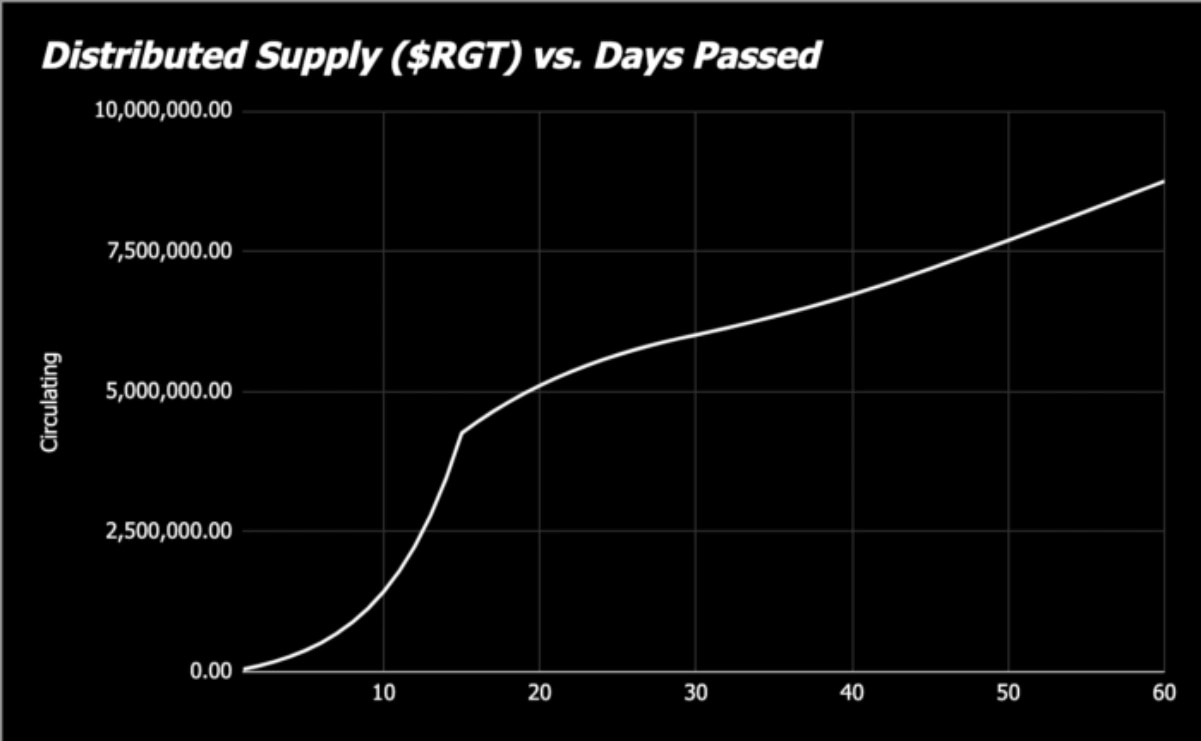

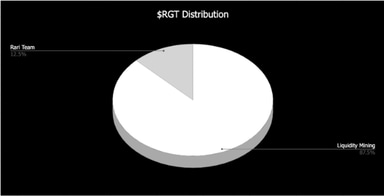

Token Distribution

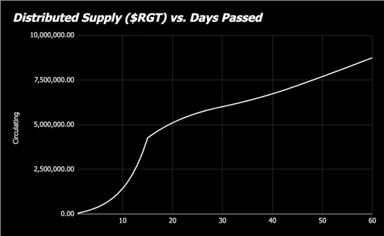

Rari team believes in fair distribution and liquidity mining. The 87.50% of the token supply will be deposited to depositors within a short 60 day period. The remaining tokens (12.5%) are reserved for the team and subject to The Rari Vesting Plan. RGT will be burned on every cent made by the protocol (70% of all revenues to be exact), decreasing the total supply of the token as the protocol succeeds. RGT also leverages the new Rari Protocol V2.

How to earn interest in Rari ?

The users can access Rari pools by signing in with any of the popular Ethereum wallets like MetaMask, Portis, Authereum, Coinbase Wallets, Torus, or Fortmatic. They can also use the Wallet Connect interface to login with any of the mobile wallets. They can deposit Ethereum or ERC20 token to the pool/pools of their choice and Rari protocol automatically start earning interest for the deposited fund.

Also, the users can participate in Liquidity Mining to earn the Rari Governance token. In order to earn RGT, all you have to do is deposit into one of the pools mentioned above. The rewards will be distributed proportionally to the number of deposits that a user has within the protocol across all pools compared to the total deposits within the protocol across all pools. So For example, if a user has $400,000 USD in the protocol and the protocol has $4,000,000 and 300,000 $RGT are being distributed on that day and the user held their money in for the entire day, they would earn 10% of the distribution: 30,000 $RGT tokens. Nearly half of the token is distributed within the first 15 days. Currently, all three pools offer 15% extra returns in RGT.

Fees & Revenue

There are fees associated with Rari Protocol usage. Rari Capital Robo-advisor has three sets of fees for the protocol currently which include performance fee, withdrawal fee, and a time-based transfer fee for early $RGT transfers.

Performance Fee

Rari capital takes a 9.5% fee on all profits accrued through the Rari Protocol. This fee powers Rari's revenue generated from the Rari protocol and it depends on some factors. For example, if a user deposits $100k USD into Rari protocol and makes $20k across 1 year in year in return, Rari protocol receives fees of $1.9k. (i.e. user deposits $100k → user makes $20k across 1-year → Rari Protocol receives $1.9k) . These Fees can be negated or lowered by staking $RGT within the Rari Protocol.

Withdrawal Fee

There is a 0.5% withdrawal fee for all withdrawals made from the yield and stable pools. This 0.5% figure is inspired by yEarn fees, as they have the same standard for their yVaults. Currently, 0.5% fees taken on assets when withdrawing from the Rari Protocol yield or stable pool, but there is no fee taken on ETH pool. For example, if a user withdraws $100k in RSPT or RYPT, the withdrawal fee will be $500. There is no fee for withdrawal of REPT.

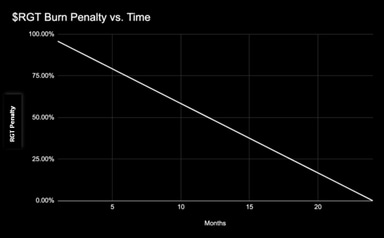

RGT Claim Fee

The RGT Claim Fee is a fee that takes place when a user attempts to claim their RGT token within the first 60 days of earning it. An Attempt to claim the token right after earning will result in a 33% fee. This fee is just sent to the burn address to lower the supply. From there, it decreases linearly across the subsequent 60 days. If the user waits for sixty days, he will not have any claim fee[17].

Fees are summarized in the table below.

| Sr No | Performance Fee | Withdraw Fee | RGT Claim Fee |

|---|---|---|---|

| 1 | Fees are taken on net profit made | Fee applied on withdrawing an asset from the Rari pool | Fee on claiming earned RGT within first 60 days from the start date |

| 2 | 9.5% yearly of net profit | 0.5% of withdrawal amount | 33% on the first day and it decreases linearly for 60 days. No fee after 60 days. |

Revenue

The revenue generated from fees and etc is distributed in three parts. 70% sent to buyback and burn mechanism that will occur at 10:00 AM PT at the beginning of each quarter. The first burn will begin on January 1st, 2021. 25% is allotted to the Rari Treasury and the rest 5% goes to the Rari Foundation.

Risk Management

Note that there are different risks regarding smart contracts, financials, and centralization with different protocols and categories like lending, Yield Farming, or Automated Market Makers. To admit new strategies and protocols into the Rari Capital pools, such as the stable pool and yield pool, each strategy must be evaluated for risk. This evaluation helps to decide which strategy is better for which protocol. To conduct this analysis, Rari team has created a strategy assessment framework to compare strategy risks at a glance, while offering a structure to facilitate thorough appraisal.

The team aims to create new strategies for evolving categories. Furthermore, within each category, there is a specific risk framework catered to each strategy style, which is combined to synthesize an overall strategy score. Strategy risk scores can then be presented to the community in governance proposals to add new strategies to the Rari Protocol. Rari team aims to publish a public forum for community members to conduct their own checks on strategies in the future. Shown below is a brief outline of the covered areas, inspired by DeFi Score metrics[18].

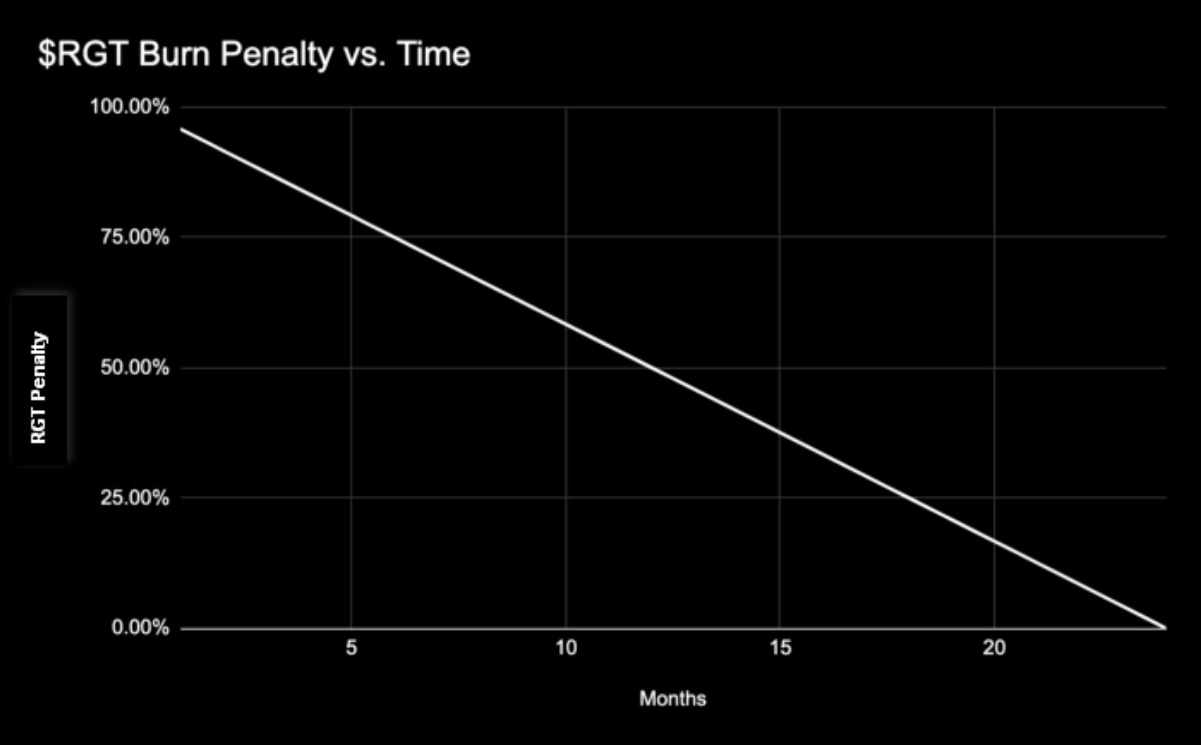

Rari Vesting Plan

Rari Vesting Plan is introduced to overcome trading vesting modules. It enables shareholders to sell at any time but forces a dynamic penalty depending on when they are selling their shares. This updated version makes use of the old vesting schedules in the best possible way by minimizing sell-side pressure and ensuring incentive agreement without needing to deal with the consequences of legacy finance.

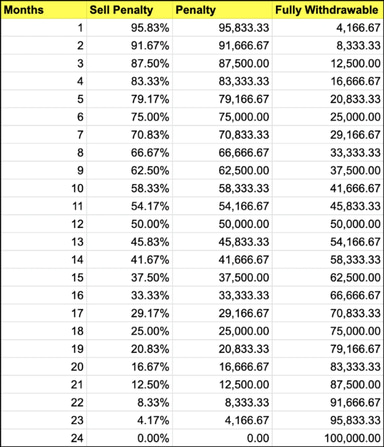

The Dynamic Penalty

The penalty forced on sellers is a dynamic one and it decreases with time. Early sellers have to pay a big penalty compared to holders. The Rari's Vesting Plan starts with determining how many tokens (Y) a shareholder gets across X years and they have spread it over 24 months. The monthly penalty comes out approximately 4.166% (100/ (X x 12)) = 100/ (2 x 12)). It means that each month, the user attempts to sell a piece of Y, they are subject to the penalty decrease, a variable dependent on X. e.g if a seller tries to sell tokens in the first month he will be able to sell only 4.166 % of his tokens and rest i.e 95.83%(100 - 4.166) will be taken as sell penalty and next month sell penalty will be reduced by 4.166% and it continues to decrease each month by 4.166% and becomes 0 eventually in 24th month and thereafter.

The Rari Vesting Plan can be shown in tabular form when spread across 24 months and with a 100,000 share distribution.

| Initial Share | Month | Sell Penalty % | Sell Penalty | Withdraw-able Amount |

|---|---|---|---|---|

| 100,000 | 1st | 95.83 % | 95,833.33 | 4,166.67 |

| 2nd | 91.67 % | 91,666.67 | 8,333.33 | |

| 3rd | 87.50 % | 87,500.00 | 12,500.00 | |

| so on. | .. | .. | .. | |

| so on. | .. | .. | .. | |

| 23rd | 4.17 % | 4,166,67 | 95,833.33 | |

| 24th | 0.00 | 0,00 | 100,000 |

Audits

Rari protocol has gone through three independent audits by Quantstamp (cryptocurrency) and a few independent parties[19].

Rari Governance Token

Commit Info

Edited By

Edited On

August 10, 2022

Feedback

Average Rating

How was your experience?

Give this wiki a quick rating to let us know!

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

[17]

[18]

[19]