Read

Edit

History

Notify

Share

PieDAO

PieDAO is a decentralized organization allowing its users to vote on the creation and parameters of pooled index funds composed of different ERC20 tokens on the Balancer protocol. PieDAO’s DOUGH token is used for governance, and the DAO infrastructure for the project is provided by Aragon. It is developed by the minds behind crypto wallet Dexwallet and point-of-sale service Dexpay, PieDAO.[1] On October 5th, 2020, PieDAO became the top DAO in the world of cryptocurrency by Total Value Locked (TVL) with over $124 million worth of crypto staked in the protocol.[2]

Services

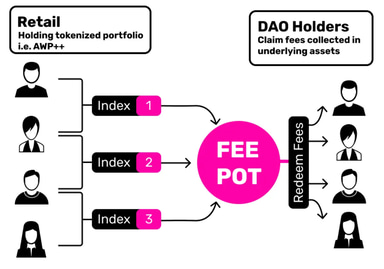

PieDAO enables the ability for anyone to create a tokenized portfolio allocation, including exposure to both crypto & traditional assets (via synthetic assets). These tokenized portfolio allocations are called "PIEs" which are available to anyone in the world with Internet access, 24/7, all on the Ethereum network. Importantly, PIEs require no minimum deposits for users along with minimal fees which are shared amongst the DAO‘s active members.

The introduction of PIEs and the PieDAO at large brings a new money lego to Ethereum’s composability. Once a core allocation is in place, different PIEs can be bundled together to create new, more stable, and diversified PIEs.

With PIEs, DeFi users could access multiple different tokenized portfolios – one filled with traditional assets, the other with crypto assets, and the last with interest-bearing Stablecoins – all in a single, easily manageable ERC20 token while incurring minimal fees.[3]

PieDAO Governance

PieDAO is governed by DOUGH tokens where tokenholders are effectively members of the organization. With DOUGH, users are able to participate in the DAO’s governance vote while proposing their own. Tokenholders are able to collaborate and vote on weighing, risk assessment of the assets, rights, and fair fees among other things.

Governance will flow from generic Discord discussion, then towards a post on the DAO’s official forum, and then finally ending in a financial specification on GitHub, called the Pie Improvement Proposals (PIPs).

If DOUGH holders do a good job governing PieDAO, PIEs will get traction and accrue significant fees that are redeemable by governance participants.

DOUGH Token

On October 2nd, 2020, PieDAO released their blueprint for DOUGH's official Tokenomics. Additionally, they also released a liquidity mining campaign and an Initial Balancer Offering.[4]

The DOUGH Initial Balancer Listing, set to open October 3rd, 2020, made 1.5m DOUGH available in a Balancer 80/20 $DOUGH/$ETH liquidity pool. This represented an initial listing price of around 0.0015ETH/DOUGH.[5]

Three days after the launch of their $DOUGH token, PieDAO reached over $124 million in total value locked, making it the number one DAO by total value locked according to DeepDAO.[6]

DOUGH v2

In the fall of 2020, PieDAO published a Medium article about the migration process from DOUGH v1 to DOUGH v2.[7] While the DOUGH v1 tokens were minted as non-transferable tokens, the DOUGH v2 tokens are transferable. PieDAO used an Aragon application to further smooth the migration process for its users.[8][9]

DOUGH Farming Season

Along with the announcement of the token was the introduction of DOUGH farming season, mass distribution of DOUGH over the course of a few weeks. The first step PieDAO took to proceed with this was the removal of 60,000,000 DOUGH v2 tokens from circulation. These tokens will be assigned to the DAO to promote development through liquidity mining, among other incentives that come with supporting the token. To be eligible for the campaign, users must be liquidity providers that stake their LP tokens to a PieDAO staking contract. "Week 1 Distribution," along with other programs, was officially launched on Saturday, October 3rd, at 6 pm UTC.[10]

Week 1 DOUGH Balancer Pools

The following Balancer pools were eligible for DOUGH during the Week 1 distribution of 250k DOUGH.

- 200k - DOUGH/ETH

- 25k - DAU/DEFI+S

- 25k - ETH/DEFI+S[11]

PieDAO Launched USD++

PieDAO announced the launch of its USD++ pool on June 16, 2020.

PieDAO has launched USD++, a hedged basket of United States dollar (USD)-denominated Ethereum (ETH)-based Stablecoins. The decentralized organization is aiming to reduce the risks associated with holding Stablecoins over the longer term and using decentralized finance (DeFi) protocols.[12]

PieDAO USD++ contains four stablecoins that have been weighted in such a way as to minimize price volatility for holders. Weightings are determined according to which stable tokens have the strongest peg, the largest market, and the greatest trust from the community.

PieDAO announced the launch of its USD++ pool on June 16, 2019, tweeting that the product comprises "a step forward to diversified portfolios which want to hold confidently cash positions".

The USD++ pool is designed to hedge and minimize the risks associated with using Ethereum-based DeFi protocols — which typically require users to deposit an asset in order to access a platform.

While many crypto traders use Stablecoins as a means to transfer and value in short time periods, many DeFi users hold stable tokens over the longer term — exposing them to greater risks.

PieDAO

Commit Info

Edited By

Edited On

October 13, 2022

Feedback

Average Rating

How was your experience?

Give this wiki a quick rating to let us know!

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]