Read

Edit

History

Notify

Share

ION Finance

ION Finance is a decentralized exchange (DEX) that integrates Telegram with decentralized finance (DeFi), allowing users to manage transactions directly within the app. It offers a user-friendly interface for various trading activities on the TON blockchain, aiming to enhance accessibility and user-friendliness of DeFi services.[1][2]

Overview

ION Finance, established in May 2023, operates as a decentralized exchange (DEX) on the TON blockchain, aiming to integrate with the Telegram app environment to improve accessibility to decentralized finance (DeFi) services.

The platform facilitates various cryptocurrency trading and investment activities, utilizing a hybrid trading model that combines a Central Limit Order Book (CLOB) with an Automated Market Maker (AMM) to cater to a diverse range of users.

By integrating with the Telegram app, ION Finance intends to leverage the platform's infrastructure to provide users with real-time alerts, trade execution, and interaction through Telegram bots and the app interface. This integration seeks to tap into Telegram's extensive user base, potentially expanding the adoption of DeFi services.

On January 18, 2024, ION Finance initiated its Alpha Launch on Telegram, followed by the deployment of the ION Finance app to the TON testnet on February 29, 2024, marking the Beta Launch.

After receiving valuable feedback from the community and addressing key issues, the beta was temporarily paused for improvements. As of March 19, 2024, ION Finance has resumed its beta testing phase with the aim of providing a smoother and more rewarding experience for users.[1][2][3][4][5][6]

Telegram Integrated Interface

ION Finance integrates with Telegram, aiming to provide a seamless interface within the app for DeFi interaction, eliminating the requirement for separate wallet applications. This integration seeks to enhance user engagement by simplifying the user journey and offering bot alerts for transaction and market activities, catering to Telegram's user base.[7]

Limit Order

The Limit Order feature on ION Finance allows users to set specific prices for buying or selling cryptocurrencies, akin to traditional limit order books. This functionality caters to strategic traders who prefer predetermined prices, adding precision and control to their trading experience.

By enabling trades based on analysis and market predictions, limit orders intend to contribute to a more efficient trading environment, facilitating deliberate transaction execution.[7]

Permissionless System

ION Finance operates as a permissionless system, aiming to ensure universal access to financial services without discrimination or counterparty risk. This approach is rooted in the ethos of TON, with transparent governance structures allowing predefined adjustments for the benefit of all participants.[7]

Hybrid Orderbook Automatic Market Maker (AMM)

The Concentrated Liquidity AMM feature on ION Finance enables liquidity providers to allocate assets to specific price ranges, with the aim of improving capital efficiency by focusing on areas with higher trading activity.

This approach seeks to enhance trading rates and liquidity utilization, potentially providing increased control over investments and higher returns for liquidity providers.

The Hybrid Orderbook Automatic Market Maker (AMM) integrates the traditional AMM with concentrated liquidity, providing liquidity providers with the ability to allocate capital within predefined price ranges. This feature is intended to optimize returns by concentrating funds in areas of highest demand, aiming to enhance trading depth and capital efficiency.

Through the customization of price ranges, liquidity providers aim to maximize return potential and increase fee revenue from more frequent trades. The hybrid system aims to offer traders flexibility with both market and limit orders, catering to various trading strategies and asset types.

This approach is anticipated to be particularly effective for stablecoin pairs and assets with sizable liquidity pools, providing a platform for liquidity provision and trading in predictable market conditions.[7][8]

Constant Product Market Maker (CPMM)

CPMM within ION Finance applies the constant product market maker model to maintain liquidity by preserving the product of token quantities in a pool at a constant value. This approach seeks to offer simplicity and accessibility to users of diverse backgrounds while effectively managing assets susceptible to rapid price fluctuations, thereby promoting stability in trading and liquidity provision.

Operating on the constant product formula (x * y = k), the CPMM model automatically adjusts prices based on token supply, facilitating fluid liquidity provision for various trading activities. This mechanism aims to ensure liquidity retention across different token pairs, enhancing the efficiency and reliability of the ION Finance ecosystem.[9]

Bin

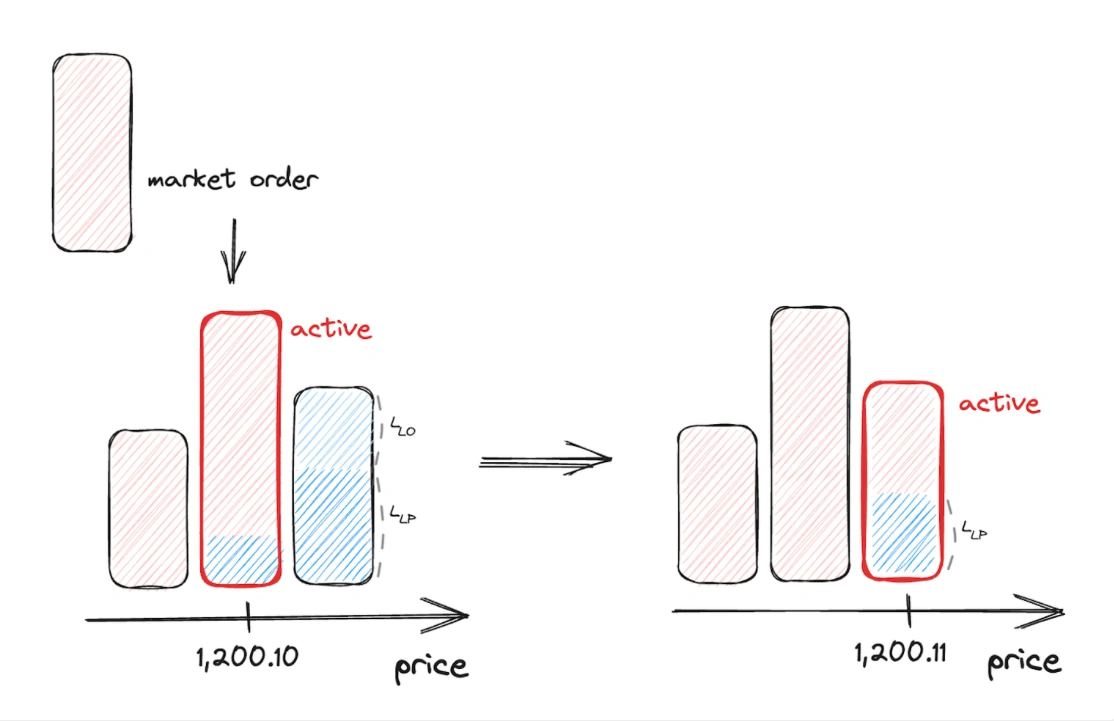

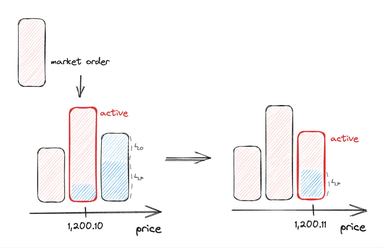

Bins within ION Finance serve as compact markets with a consistent exchange rate between two assets, akin to a condensed version of Constant Sum Market Makers pools. Each bin denotes a specific price, collectively forming the pool for exchanging token pairs.

The active bin facilitates trading, maintaining a price equivalent to the token being exchanged. As liquidity diminishes, subsequent bins are engaged to finalize trades. With fixed exchange rates, bins adhere to the constant sum price formula, potentially reducing slippage during trading transactions compared to CPMMs.[10][11]

Liquidity Providers

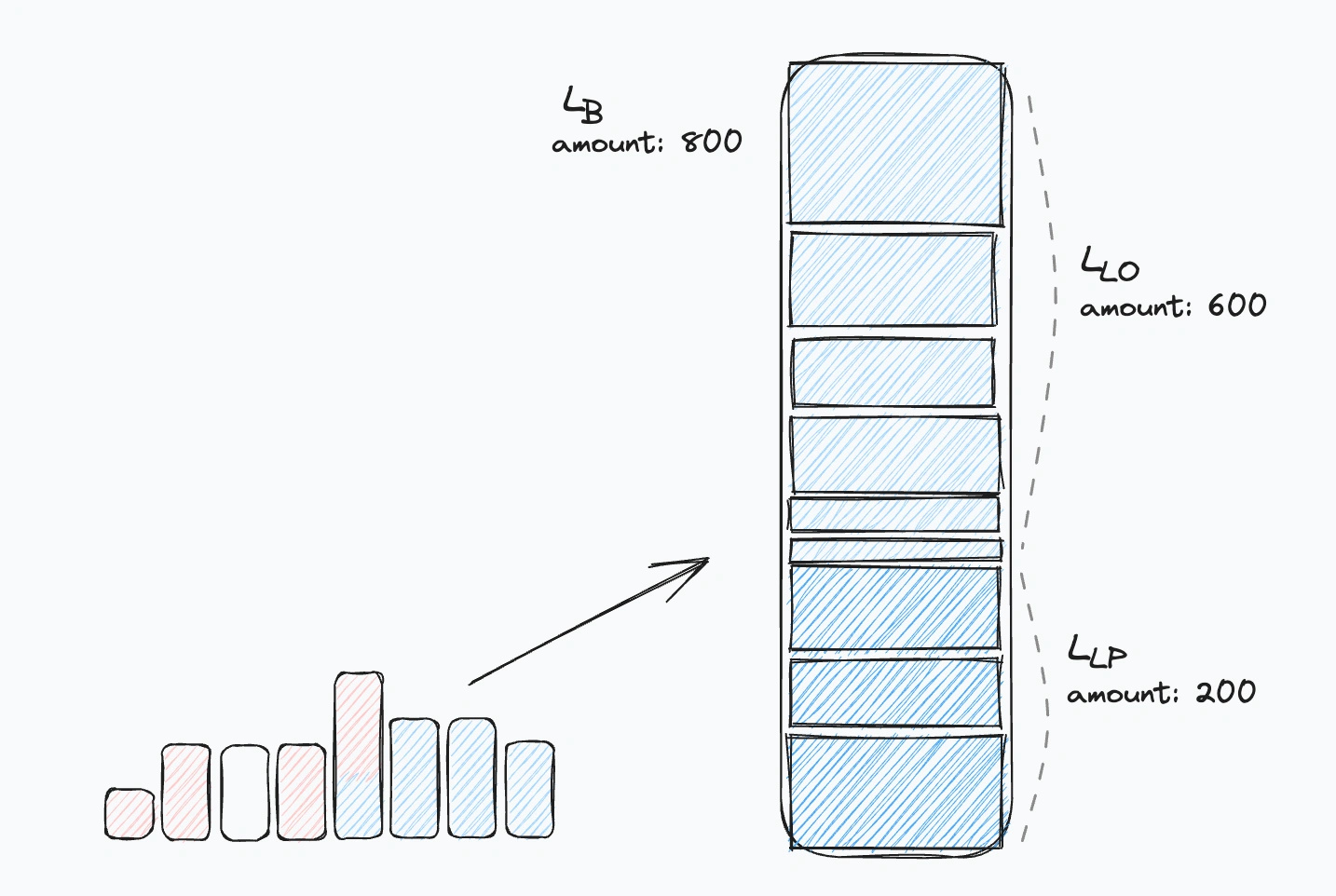

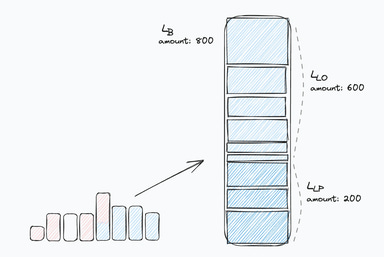

ION Finance employs liquidity providers to enhance the liquidity of its order book, aiming to facilitate smooth trading. Participants include:

- Order Makers: These users sell tokens at specific prices by depositing them into corresponding bins, facilitating exchanges when trades are executed.

- Liquidity Providers: They contribute to overall liquidity, earning transaction fees. Their tokens are converted during trades, remaining in the bin in a different token form.

Liquidity providers on ION Finance strategically allocate liquidity to specific bins, aiming to concentrate it where high trading volumes are expected, thus ensuring a consistently deep liquidity environment that adjusts to market changes.[12][13]

Pools

ION Finance provides two main pools: Stable and Volatile.

Stable pools facilitate the exchange of tokens with consistent price percentages, enhancing liquidity to reduce slippage for both liquidity providers and traders. The platform aims to support multiple asset pairings within stable pools, with a current limit of three pairs per pool.

Volatile pools enable trading between two assets with different prices, forming pairs of distinct tokens.[14]

Asynchronous Routing

ION Finance implements a unique routing system, which is a common feature in many AMM Dex platforms, with the aim of optimizing token swaps by identifying the most efficient pathway, potentially involving multiple pools for the best rate.

Due to the asynchronous nature of TON, achieving a perfect rollback is not feasible. In cases where a swap encounters excessive slippage and is interrupted midway, the system aims to provide an intermediate result.[15]

ION Finance

Commit Info

Edited By

Edited On

April 1, 2024

Feedback

Average Rating

How was your experience?

Give this wiki a quick rating to let us know!

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]