Read

Edit

History

Notify

Share

Arkham Intelligence

Arkham Intelligence is a platform that utilizes artificial intelligence to process, classify, and present on-chain data related to real-world entities behind blockchain addresses. It enables users to identify patterns, trace transactions, and provides an overview of inflows and outflows. Arkham is founded by Miguel Morel.[1][2]

Overview

Multi-Chain Integration

Arkham Intelligence integrates with multiple blockchain networks by default, collecting, aggregating, and attributing data across chains. It uses the Ultra feature to reconcile cross-chain data. Additionally, the platform allows users to analyze data specific to a particular chain or subset of chains as needed. [3]

Arkham Filters

Arkham introduces systematic transaction filtering, allowing users to filter and sort transactions on the platform based on key metrics such as time, token, USD value, and counterparty. This feature enhances the efficiency of analysis tasks, making it quicker and more convenient. [3]

Profiler

The Profiler is a vital feature in Arkham, offering users a real-time view of an entity's on-chain activities. The platform's user interface is organized into Units, each serving a specific purpose. The Profiler comprises four key Units: [3]

- Portfolio Unit: Provides a snapshot of current and historical holdings at different points in time.

- Historical Performance Unit: Focuses on the entity's financial history, showing balance fluctuations and historical profit and loss.

- Counterparties Unit: Explores exchange usage patterns and identifies top address or entity counterparties.

- Transactions Unit: Acts as a real-time log, offering an up-to-date record of the entity's complete transaction history.

The Profiler is a user-friendly tool that allows individuals to understand their on-chain activities. It covers aspects such as current holdings, financial history, counterparties, and real-time transactions. [3]

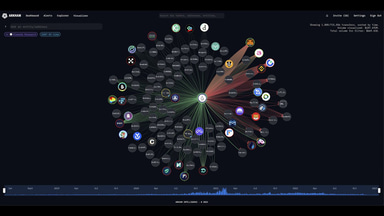

Visualizer

The Visualizer is a tool that analyzes relationships among entities by creating a network graph from selected addresses or entities. In the generated network, nodes represent entities, and their connections are formed by transactions. Users can customize the Visualizer networks using Arkham filters to focus on specific transactions of interest. [3]

Alerts

Alerts are designed for real-time monitoring and response to specific activities. They notify Arkham users through their selected platform about transactions that meet customized criteria set using Arkham filters. This facilitates prompt identification of transactions of interest amidst the ongoing network activity. [3]

Dashboard

The Dashboard allows users to compile entities and addresses of interest to create custom data feeds. On the dashboard's home page, a list of tracked entities and their recent transactions is presented. Users can establish personalized dashboards for specific entities or data categories, such as "market makers," "ETH whales," or "OTC desks." These dashboards include custom units like holdings, balance history, and transactions for one or multiple entities. Users can easily share these dashboards with others via URL. [3]

Intel-to-Earn

The Arkham Intel Exchange functions as a platform for buying and selling crypto intelligence in a decentralized manner. It facilitates the trading of the native currency, ARKM, for information such as entity labels, hacker tracing, and curated data feeds. Buyers can request intelligence through bounties, while sellers offer their intelligence through auctions. Both bounties and auctions operate through audited smart contracts, ensuring that funds are never held by a centralized entity. [4]

The establishment of a market for intelligence by The Arkham Intel Exchange, alongside the associated DATA program, enables those generating intelligence to earn value for their work, known as "intel-to-earn." This setup encourages the production of intelligence as a public good. [4]

Arkham Intel Exchange

The Arkham Intel Exchange is a platform connecting users for buying and selling crypto intelligence. It operates as a decentralized economy where the native currency (ARKM) is exchanged for information, such as entity labels, hacker tracing, and curated data feeds. Buyers use bounties, and sellers participate in auctions, both conducted through audited smart contracts with no centralized custody of funds. [3]

The Arkham Intel Exchange, along with the DATA program, establishes a market for intelligence. This allows those creating intelligence to derive value from their work through "intel-to-earn," incentivizing the production of intelligence as a public good. [3]

Bounties

In Arkham, buyers utilize bounties as a means to request and compensate for specific intelligence on the exchange using the ARKM currency. To post a bounty, buyers specify the desired information and lock in the bounty contract by committing a certain amount of ARKM as the reward. Others interested in the same intelligence can participate by contributing an equivalent amount of ARKM, thus increasing the total reward. [3]

If the original bounty poster wishes to remain the sole recipient of the intelligence, they can opt to buy out the stakes of others who joined. This involves staking an additional amount equal to the sum of the joiners' stakes. [3]

Bounty hunters claim the bounty by submitting relevant intelligence on the exchange. To prevent spam, bounty hunters must stake 10 ARKM in the smart contract, forfeiting it if their submission is rejected. If the Arkham Foundation approves the submission, the exchange registers this response and informs the bounty smart contract. A 15-day unlock timer is initiated, allowing the bounty hunter to withdraw the ARKM in the bounty contract (minus the exchange fee) to the address used to stake the submission ARKM. Early withdrawal before the 15-day lockup incurs a 10% fee. [3]

In the case of a rejected submission, the submission ARKM remains in the smart contract and is added to the bounty for future claims. This bounty system establishes a structured and incentivized process for obtaining valuable intelligence on the Arkham platform, while also discouraging spam and ensuring fair compensation for successful submissions. [3]

Auctions

In Arkham, sellers use auctions to offer intelligence for sale. These auctions follow a structure similar to NFT marketplaces, allowing sellers to set a purchase price, minimum bid, and auction duration. Before an auction begins, Arkham verifies the submitted intelligence. To prevent spam, auction holders stake 10 ARKM with their submission, which is forfeited if the submission is rejected. Like bounties, auctions have a 15-day lock-up period before a winning bid can be withdrawn from the auction smart contract. Auctioneers can opt for an early withdrawal, subject to a 10% fee. This system provides a controlled process for selling intelligence on the Arkham platform, discourages spam, and ensures fair compensation for successful auctions. [3]

DATA Program

Arkham's Decentralized AI Training Accelerator (DATA) Program is designed as a supplementary intel-to-earn system within the exchange. In this program, individuals, known as sleuths, earn ARKM by contributing intelligence for training Ultra and enhancing the overall data on the platform. Submissions to the DATA program include specific labels, entity attributions, data sources, and additional leads. The Arkham Foundation reviews these submissions, and if approved, sleuths receive an ARKM payout following the DATA price list. This direct submission system establishes a revenue stream for sleuths and contributes to the development of a decentralized community of intelligence analysts for the platform. [3]

Direct submissions provide Arkham with a way to acquire intelligence and training data directly from the community. Sleuths can earn ARKM for their contributions without the uncertainties of auctions or the specificity constraints associated with bounties. Rewards for approved intelligence submissions are determined by a predetermined price list. Three types of submissions are accepted: address labels or disputes, entity submissions, and high-priority intel. [3]

High-priority intel encompasses various non-address, non-entity submissions, such as data sources generating multiple labels or intelligence related to urgent and high-profile cases. Sleuths participate in the DATA program by submitting intelligence directly on the platform using a simple form where they present their findings and justify their validity. Approved submissions receive the designated payout. [3]

ARKM Token

ARKM is the utility token of Arkham. The token is part of the intel-to-earn economy and of the incentives system of the platform, which is divided into ARKM Rewards and ARKM Discounts. ARKM is also used in the governance of the Arkham Intel Exchange. [3]

ARKM Rewards

The Rewards Program is the first component of the ARKM incentive system, allowing users to earn ARKM for actions beneficial to the Arkham community. The eligible actions for rewards may vary depending on the ecosystem's current state and can include activities such as user referrals and the production of research and analysis. [3]

The system also provides grants that support projects contributing to the ecosystem, as well as ecosystem partner rewards.

ARKM Discounts

ARKM Discounts are a significant aspect of the ARKM incentive system, providing users with discounts on the Arkham platform through two methods: [3]

- Pay-in-ARKM Discount: Users receive a 20% discount on platform payments when using ARKM for transactions.

- Holding Discount: Users can earn a holding discount of up to 50%, depending on the size and duration of their ARKM holdings as detailed in the provided table. To prevent potential abuse, such as short-term borrowing, users are required to lock ARKM for a minimum of 30 days to qualify for holding discounts.

These discounts are cumulative, allowing users to combine them. For example, a user can use ARKM for payments to receive a 20% discount and also maintain ARKM holdings to qualify for the holding discount, resulting in a maximum discount of 60%. Pay-in-ARKM discounts are facilitated through a browser wallet while holding discounts are implemented through a straightforward, audited smart contract. Users can withdraw tokens from the contract at any point after the specified locking period has concluded. [3]

Initial Allocation

ARKM has a total initial supply of 1,000,000,000 tokens, distributed as follows: [5]

- Ecosystem Incentives and Grants: 37.3%

- Core Contributors: 20%

- Investors: 17.5%

- Foundation Treasury: 17.2%

- Binance Launchpad: 5.0%

- Advisors: 3.0%

The ecosystem fund is further sub-divided as follows: [5]

- Community rewards: 28.7% (10.7% of total)

- Contributor Incentive Pool: 26.8% (10.0% of total)

- DON PoS Rewards: 26.8% (10.0% of total)

- Ecosystem Grants: 17.7% (6.6% of total)

Unlocking Schedule

The unlocking schedule for ARKM is designed to manage the release of tokens gradually over specific periods after listing: [5]

- Total Supply: The entire ARKM supply becomes fully unlocked 7 years after its listing.

- Initial Circulating Supply: Initially, only 15% of the total supply is part of the circulating supply.

- Investor, Core Contributor, and Advisor Tokens: Tokens allocated to investors, core contributors, and advisors are locked for 1 year after listing. Starting 1 year after listing, these tokens unlock gradually over 3 years.

- Ecosystem Fund: Tokens from the ecosystem fund unlock over a period of 5 years.

- Foundation Treasury: Tokens from the foundation treasury have a longer unlocking period, extending over 7 years.

Governance

ARKM holders can submit and approve Arkham Improvement Proposals (AIPs) to update the exchange’s smart contracts, alter exchange fees, and use ARKM allocated to the Arkham Foundation Treasury. [6]

In terms of Exchange Smart Contracts, improving the on-chain implementation is a key focus of ARKM governance. The initial implementation is kept simple and effective for security and clarity, with the flexibility to introduce complexity over time based on experience and insights. [6]

AIPs may impact the size of exchange fees, initially set at 2.5% for makers and 5% for takers. These fees can be subject to change through proposed improvements. [6]

The Arkham Foundation Treasury, unlocking over 7 years post-network launch, is dedicated to advancing the goals of the Arkham ecosystem. AIPs can suggest how to utilize these funds, including supporting projects addressing challenges like the intelligence oracle problem, recognizing significant contributions, and sustaining network operations. [6]

Addresses holding or delegated with at least 0.1% of the total ARKM supply can submit an Arkham Improvement Proposal (AIP) for consideration by ARKM holders. For a proposal to pass, it must meet two conditions: 1) a minimum of 7% of tokens must vote in favor, and 2) there should be at least twice as many votes in favor as against. Proposals undergo a 7-day voting period, and if they fail to secure the required support by the end of this period, they are rejected. Before submitting an AIP, an address can submit a Consultation outlining a potential proposal for feedback and discussion. The threshold for submitting a Consultation is 0.01%. [6]

Funding

Arkham Intelligence raised $12,000,000 through Series A funding from Coinbase Ventures, Digital Currency Group, Bedrock Capital, Tim Draper, Peter Thiel, Sam Altman, and others. [7]

Arkham Intelligence

Commit Info

Edited By

Edited On

February 9, 2024

Feedback

Average Rating

How was your experience?

Give this wiki a quick rating to let us know!

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]